|

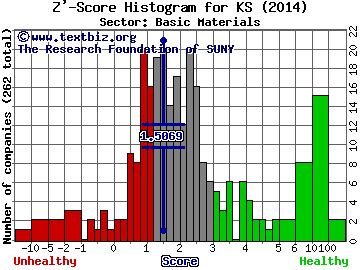

Default prediction by Z-Score (what's this?).

View the other companies in the same industry : Paper Packaging

Alternative Z-Scores designed for non-public companies (i.e. take these with a grain of salt):

For manufacuring companies:

Sector Industry

|

For non-manufacturing companies:

Sector Industry

|

|